Mastering timely payments A Landlord's Guide on How to Address and Prevent Frequent Late Rent Payments

As a landlord, consistent and timely rent payments are the lifeblood of a successful property management venture. However, dealing with frequent late rent payments can be a significant source of frustration and financial strain. In this comprehensive guide, we’ll explore effective strategies from a landlord’s perspective on how to address and prevent the recurring issue of tenants consistently paying rent late.

- Establish Clear Rent Policies:

Begin by setting clear and explicit rent payment policies in your lease agreement. Clearly outline the due date, grace period (if any), and any penalties for late payments. This ensures that tenants understand the expectations from the outset.

- Automate Rent Collection:

Leverage technology to streamline the rent collection process. Implement automated rent collection systems, such as online payment platforms, to make it convenient for tenants and reduce the likelihood of late payments. Automation also helps in maintaining a transparent record of payment history.

- Open Communication Channels:

Encourage open lines of communication with your tenants. Establishing a relationship where tenants feel comfortable discussing financial challenges can lead to early identification of potential payment issues, allowing for proactive solutions before payments become consistently late.

- Send Timely Reminders:

Send polite and timely reminders a few days before the rent is due. This gentle nudge can serve as a proactive measure, ensuring tenants are reminded of their upcoming payment obligations and prompting them to prioritize their financial responsibilities.

- Offer Incentives for Early Payments:

Consider implementing a reward system for tenants who consistently pay rent on time or even before the due date. This can range from small discounts on future rent to other non-monetary incentives, fostering a positive relationship and encouraging prompt payments.

- Enforce Late Payment Penalties:

Clearly outline late payment penalties in the lease agreement and enforce them consistently. This not only acts as a deterrent but also helps compensate for any additional administrative or financial burdens incurred due to late payments.

- Educate Tenants on the Importance of Timely Payments:

In your lease agreement or during move-in orientations, emphasize the importance of timely rent payments. Explain how consistent late payments can impact your ability to maintain the property and provide essential services, fostering a sense of responsibility among tenants.

- Conduct Regular Lease Reviews:

Periodically review your lease agreements to ensure they remain up-to-date and effective. If necessary, make adjustments to rental terms, late fees, or other relevant clauses based on changing market conditions or your own experiences as a landlord.

- Consider Lease Renewal Terms:

When renewing leases, consider implementing clauses that reward tenants with a positive payment history. This can include options for longer lease terms, providing stability for both parties and reducing the likelihood of late payments.

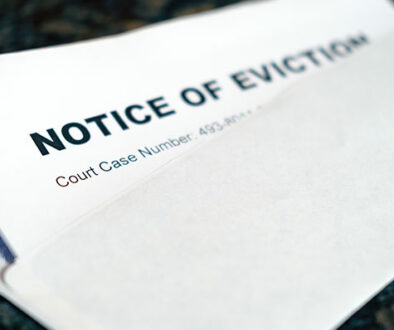

- Seek Legal Advice When Necessary:

If late payments persist despite your efforts, seek legal advice to understand your rights and the appropriate steps to take. A legal professional can guide you through the eviction process or other legal actions if they become necessary.

Effectively addressing and preventing frequent late rent payments requires a proactive and strategic approach from landlords. By establishing clear policies, leveraging technology, fostering open communication, and considering both incentives and penalties, landlords can create a positive and responsible tenant community while maintaining the financial stability of their property management venture.

From a property owner’s perspective; when dealing with delinquent tenants, eviction is the legally sanctioned process of regaining possession of one’s property.

Eviction becomes a necessary recourse when tenants consistently fail to meet their rent obligations or breach lease agreements. This often challenging and time-consuming procedure involves serving notices, filing court documents and attending hearings. Ultimately, eviction is a means to protect the landlord’s property investment and financial stability while upholding the legal rights and responsibilities of both parties involved.

Eviction can be a complex process that should be approached with care and adherence to the law. While it is a last resort, sometimes it becomes necessary to protect the interests of the landlord. By understanding the legal grounds, communicating effectively, seeking legal advice, and following the proper procedures, landlords can navigate eviction problems while maintaining legal compliance and safeguarding their property investments.

With Failure To Launch, landlords have an expedited and cost-effective solution to efficiently address eviction challenges without the usual prolonged timelines and costs associated with traditional legal channels.

You don’t have to go through expensive courts or eviction lawyers.